Scandinavia’s “most beautiful bridge in the world” – is this at the end of the transport chain or at the start of a new one ?

Industry Analysis ScandinaviaA new bridge, located over 200 miles North of the Arctic Circle, is being reported as illustrating the reach and potential of the One-Belt, One-Road initiative – in some quarters.

To locals of Narvik, Norway, and the surrounding areas, the new Halogaland Bridge, crossing the Rombaken Fjord, is a very welcome addition to the local infrastructure, allowing considerable savings in time. The local population is justifiably proud, dubbing it the most beautiful bridge in the world. However, peculiar aspects of the bridge construction and siting have been absorbed into the wider debate about future links between East and West.

The leading contractor on the bridge was Sichuan Road & Bridge Co, a Chinese company, which was responsible for supplying and installing all steelwork in what is the largest suspension bridge North of the Arctic Circle. The bridge was opened in December 2018 in a ceremony that included the Norwegian Prime Minister and the Chinese Ambassador to Norway.

The Chinese-led One Belt, One Road initiative of re-establishing the centuries old East West Trade route immediately conjures up visions of the land route through Central Asia, or the maritime route passing India and entering the Mediterranean via the Suez Canal. However, what is gaining ground is the concept of an Arctic Corridor, The North East Passage (or the Polar Silk Road), to connect the Northern areas of Scandinavia, Finland and Russia with China and this is where the bridge adds a further link in the chain. Not, as one would suspect, the end of the chain, but rather one of the first links in a new chain.

Interest is centered around the ice-free Norwegian port of Kirknes, located just 15Km West of Russia on the Barents Sea. It’s the first “Western” Port for any vessel arriving from China via the North East Passage. Savings in distance are huge – Shanghai to Kirknes, for example, is 30% shorter via the Northern route than Shanghia to Rotterdam via Suez.

A recent joint study by the Finnish and Norwegian governments outlined the concept of making Kirknes a hub port for the Northern Europe / China trades, with a proposed new 520 km railway to the Finnish city of Rovaniemi linking into existing infrastructure and directly to the Baltic States.

Of course, all of this would take a number of factors to align. Most notably a high degree of cooperation between Norway, Finland, Russia and China – historically uneasy bedfellows. There are also environmental considerations and an assumption that global warming will continue its assault on the pack ice.

Despite its remote location in the land of the Midnight sun, the most beautiful bridge in the world is not immune from the world of geo-politics and trade.

Scandinavia month: Fun Facts!

Industry Analysis ScandinaviaAs LSR is based in Hong Kong we thought we’d kick off with some comparisons between Scandinavia (Norway, Sweden, Denmark), Finland and Iceland and our home turf of Hong Kong SAR and China.

- Coastline: Norway (25,148km) = 2 x China (14,500km).

- If you lined up the population of China and placed the Nordic countries’ people evenly then you’d be shaking hands with a Nordic person once every 66 shakes.

- Finland has a word that describes the concept of drinking alone, at home, in your underwear – “kalsarikänni”. Luckily for my family, there is no such term, or concept, in Mandarin.

- Deadweight Tonnage: China beneficially owns 183 million, Norway 59m, Denmark 39m and Sweden 6m.

- Who is the most seafaring nation? In terms of dwt per person then the Norwegians have saltwater running through their veins and parrots on their shoulders, with 11 dwt per person, The Danes are pretty salty too, with 6.8 tonnes. In contrast, the Swedes are barely-brackish at 0.6 tonnes and the Chinese remain firmly on dry land with 0.13 tonnes per person.

Photo by J. Jacobsson on Unsplash

Restructuring Land Grab?

Industry Analysis RestructuringSingapore aims to be Asia’s restructuring hub. The commercial world is now seeing the plan unfolding.

LSR recently assisted a client who was baffled about a debtor who had “gone into CHAPTER 11 in SINGAPORE”, a scheme outside the USA you might be unaware of.

Although this issue was discussed widely in legal circles, it’s only with the passage of time that its effect is seen within the commercial world, as companies’ counterparts fail and creditors seek to recover debts.

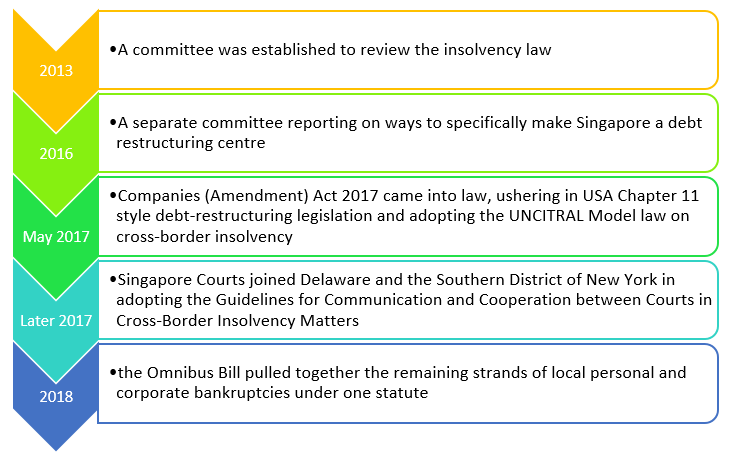

Following on from last week’s post about Cross-Border Insolvency, we briefly outline Singapore’s bold move to establish itself as the debt-restructuring hub of Asia.

Within 6 months of the new laws being enacted in 2017 there had already been some significant cases brought within its jurisdiction. These included Bakrieland Development Attilan Group, TT International, Emas Offshore and Nam Cheong. More recent cases have included the current high profile Hyflux case, whose initial“automatic”30 day moratorium was made in May 2018. More time was granted until November 2018 and then again until April 2019, despite objections from some creditors concerned about transparency.

So, what are the MAIN points about Singapore’s restructuring environment? Please refer to the “Companies (Amendment) Bill 2017” and “FACT SHEET ON THE COMPANIES (AMENDMENT) BILL 2017 AND LIMITED LIABILITY PARTNERSHIPS (AMENDMENT) BILL 2017”.

Overall, the recent changes in Singapore have been well received. It is still in its infancy and “the law in practice” will develop over time, being tested by applications from one party or another seeking an advantage. However, there is no denying that Singapore has stolen a march on its rivals in the region, invested in support infrastructure and sucked in legal expertise to capitalise on this new centre of opportunity.

Cross-Border Insolvency – Global vs Local

Cross-Border Insolvency Industry AnalysisThe world is a global marketplace, held together by mutual commercial relationships, mutual laws and mutual trade practices.

Nowadays the demise of one company can have a dramatic, news-breaking, effect on companies and consumers around the world. The collapse of Hanjin Shipping in 2016 not only put into doubt whether consumers would receive their Samsung TVs for Christmas, but also asked serious questions about how an orderly liquidation or rehabilitation could be conducted if major assets (the ships) were spread across the world and subject to a diverse range of domestic insolvency regimes.

This situation highlighted THREE areas of uncertainty – choice of law, choice of jurisdiction and enforcement of rulings. There are two competing extremes of cross-border insolvency resolution – commonly called the Universal Approach and the Territorial Approach.

Universal Approach – handling of all claims and assets would be resolved in the debtor’s country, under the laws of that jurisdiction and that all courts would act under commonly agreed international laws.

This remains an aspiration of course, waiting for the time when the world operates under one system of laws. The leading attempt is seen in relation to the United Nation’s UNCITRAL Model Law, dating from 1997. Thus far over 45 jurisdictions have signed up, including the USA, UK, South Korea, Japan and South Africa. No China at present. The members of the European Union have a similar agreement, the EC Regulation on Insolvency Proceedings 2000.

Alternatively, the Territorial Approach would see courts in each jurisdiction seize and distribute assets that happened to be under their control, in accordance with local laws. There is an obvious upside for local creditors in this scenario and assets could be liquidated very quickly – but at what cost to other creditors?

So, one extreme doesn’t truly exist and the other provides satisfaction to only a few lucky parties. Hence there is a movement to meet in the middle, with Modified Universalism and Cooperative Territorialism, also known as Hybrid Approaches. Of the two, Modified Universalism is making the most headway. This was the system adopted in the case of Hanjin Shipping and proved the practicality of the system.

In the Hanjin instance individual countries were requested to agree (with South Korea) that the best place to conduct proceedings would be in Seoul. Jurisdictions where assets happened to be located deferred to the South Koreans, whilst retaining the discretion of local courts to protect local creditors’ rights. These rights extend to the point of negotiating special treatment before releasing locally seized assets to the main proceedings, by making sure that in so doing this did not conflict with their country’s public policy.

Going forward, the Modified Universal Approach is the one that is being increasingly adopted. Its overall transaction costs are certainly lower than the Territorial argument.