Have you ever felt that pursuing litigation is too expensive and the risks too great? There’s no need to……

Industry Analysis Litigation Litigation FundingOver recent years litigation funding has certainly gained traction, with new providers springing up rapidly. It opens up the law to companies who would otherwise be unable to seek redress due to the expenses involved. This mirrors the support that is offered on a more personal, social welfare, basis to individual citizens via government sponsored legal aid.

The main driving force behind the recent growth in the size of the available funds and also in the number of these firms now in operation is MONEY. Quite simply, as an investor in a litigation funding firm you can make a great return on your investment.

How does it work?

- Litigation funders have access to cash

- Claimants and their lawyers approach a litigation funder and explain their case

- Litigation funders assess the case on its merits and the likely return (successful judgement awards) that can be made against the costs to fund the case.

- Assuming the scenario fits their in-house criteria, they agree on a return (e.g. percentage of the settlement), advance the money and step back.

Litigation funders do not normally get involved in the litigation process, provide lawyers, advise, nominate or dictate which lawyers should be used, although a monitor will be kept in order to fully manage the investment. In its purest form this is a rational, return-on-investment decision made by the litigation funders based on the offer presented to them by their client – the claimant in the law suit.

Someone else pays for your legal costs – any other advantages?

- Manage legal risks. There is no impact on the Profit and Loss account or Balance Sheet. Litigation finance is not a loan that needs to be paid back so there is no need for the disclosure of allowances, liabilities or contingencies to impair the financial statements.

- Positive working capital. The arrangement releases funds for normal commercial purposes that would otherwise have needed to be set aside for legal costs.

- Fair treatment. In any commercial veneture there is the possibility that valid claims that otherwise would not have been pursued are actually pursued. It may be taking it too far to claim that a company’s legal department could be transformed from a cost centre to a profit centre, but the sentiment is correct.

- Adverse cost awards. In jurisdictions where adverse costs are awarded against litigants it is feasible that entering into litigation may result in doubling legal expenses. However, Litigation funders can and do provide insurance cover for such scenarios.

Any downsides?

Not many. Access to legal cost funding may make a company more litigious, perhaps to the detriment of reputation.

Can you use litigation funding in all jurisdictions?

No – not yet. The concept of champerty is still a tort and crime in some common law jurisdictions but we will cover this aspect in later posts. However, the bottom line is that you’re good to go in Australia, England and the USA.

Scandinavia’s “most beautiful bridge in the world” – is this at the end of the transport chain or at the start of a new one ?

Industry Analysis ScandinaviaA new bridge, located over 200 miles North of the Arctic Circle, is being reported as illustrating the reach and potential of the One-Belt, One-Road initiative – in some quarters.

To locals of Narvik, Norway, and the surrounding areas, the new Halogaland Bridge, crossing the Rombaken Fjord, is a very welcome addition to the local infrastructure, allowing considerable savings in time. The local population is justifiably proud, dubbing it the most beautiful bridge in the world. However, peculiar aspects of the bridge construction and siting have been absorbed into the wider debate about future links between East and West.

The leading contractor on the bridge was Sichuan Road & Bridge Co, a Chinese company, which was responsible for supplying and installing all steelwork in what is the largest suspension bridge North of the Arctic Circle. The bridge was opened in December 2018 in a ceremony that included the Norwegian Prime Minister and the Chinese Ambassador to Norway.

The Chinese-led One Belt, One Road initiative of re-establishing the centuries old East West Trade route immediately conjures up visions of the land route through Central Asia, or the maritime route passing India and entering the Mediterranean via the Suez Canal. However, what is gaining ground is the concept of an Arctic Corridor, The North East Passage (or the Polar Silk Road), to connect the Northern areas of Scandinavia, Finland and Russia with China and this is where the bridge adds a further link in the chain. Not, as one would suspect, the end of the chain, but rather one of the first links in a new chain.

Interest is centered around the ice-free Norwegian port of Kirknes, located just 15Km West of Russia on the Barents Sea. It’s the first “Western” Port for any vessel arriving from China via the North East Passage. Savings in distance are huge – Shanghai to Kirknes, for example, is 30% shorter via the Northern route than Shanghia to Rotterdam via Suez.

A recent joint study by the Finnish and Norwegian governments outlined the concept of making Kirknes a hub port for the Northern Europe / China trades, with a proposed new 520 km railway to the Finnish city of Rovaniemi linking into existing infrastructure and directly to the Baltic States.

Of course, all of this would take a number of factors to align. Most notably a high degree of cooperation between Norway, Finland, Russia and China – historically uneasy bedfellows. There are also environmental considerations and an assumption that global warming will continue its assault on the pack ice.

Despite its remote location in the land of the Midnight sun, the most beautiful bridge in the world is not immune from the world of geo-politics and trade.

Scandinavia month: Fun Facts!

Industry Analysis ScandinaviaAs LSR is based in Hong Kong we thought we’d kick off with some comparisons between Scandinavia (Norway, Sweden, Denmark), Finland and Iceland and our home turf of Hong Kong SAR and China.

- Coastline: Norway (25,148km) = 2 x China (14,500km).

- If you lined up the population of China and placed the Nordic countries’ people evenly then you’d be shaking hands with a Nordic person once every 66 shakes.

- Finland has a word that describes the concept of drinking alone, at home, in your underwear – “kalsarikänni”. Luckily for my family, there is no such term, or concept, in Mandarin.

- Deadweight Tonnage: China beneficially owns 183 million, Norway 59m, Denmark 39m and Sweden 6m.

- Who is the most seafaring nation? In terms of dwt per person then the Norwegians have saltwater running through their veins and parrots on their shoulders, with 11 dwt per person, The Danes are pretty salty too, with 6.8 tonnes. In contrast, the Swedes are barely-brackish at 0.6 tonnes and the Chinese remain firmly on dry land with 0.13 tonnes per person.

Photo by J. Jacobsson on Unsplash

Restructuring Land Grab?

Industry Analysis RestructuringSingapore aims to be Asia’s restructuring hub. The commercial world is now seeing the plan unfolding.

LSR recently assisted a client who was baffled about a debtor who had “gone into CHAPTER 11 in SINGAPORE”, a scheme outside the USA you might be unaware of.

Although this issue was discussed widely in legal circles, it’s only with the passage of time that its effect is seen within the commercial world, as companies’ counterparts fail and creditors seek to recover debts.

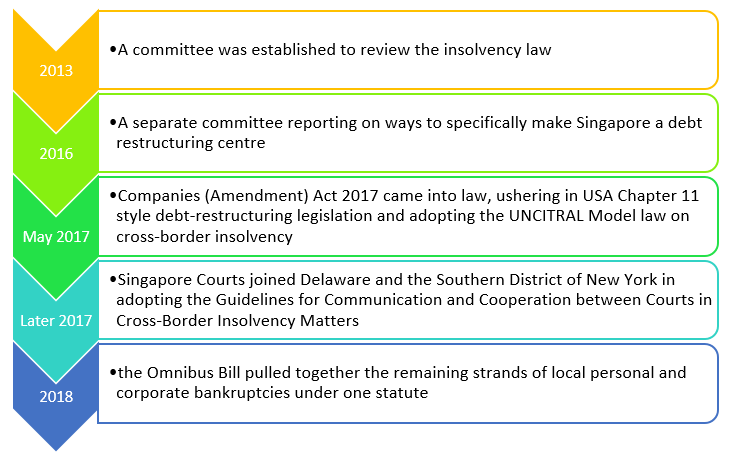

Following on from last week’s post about Cross-Border Insolvency, we briefly outline Singapore’s bold move to establish itself as the debt-restructuring hub of Asia.

Within 6 months of the new laws being enacted in 2017 there had already been some significant cases brought within its jurisdiction. These included Bakrieland Development Attilan Group, TT International, Emas Offshore and Nam Cheong. More recent cases have included the current high profile Hyflux case, whose initial“automatic”30 day moratorium was made in May 2018. More time was granted until November 2018 and then again until April 2019, despite objections from some creditors concerned about transparency.

So, what are the MAIN points about Singapore’s restructuring environment? Please refer to the “Companies (Amendment) Bill 2017” and “FACT SHEET ON THE COMPANIES (AMENDMENT) BILL 2017 AND LIMITED LIABILITY PARTNERSHIPS (AMENDMENT) BILL 2017”.

Overall, the recent changes in Singapore have been well received. It is still in its infancy and “the law in practice” will develop over time, being tested by applications from one party or another seeking an advantage. However, there is no denying that Singapore has stolen a march on its rivals in the region, invested in support infrastructure and sucked in legal expertise to capitalise on this new centre of opportunity.